LEGAL NOTICE

CITY OF SOUTHFIELD

2024 WINTER TAXES

Please take notice that 2024 County and School Taxes are payable at the City Treasurer's Office, 26000 Evergreen Road from December 1, 2024, through February 14, 2025, without penalty.

On February 15, 2025, three percent (3%) shall be added for late payment. After March 1, 2025, property taxes will be payable only to the Oakland County Treasurer's Office, 1200 North Telegraph Road, Pontiac, MI 48341.

IRV M. LOWENBERG

City Treasurer

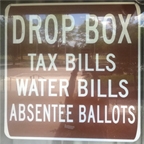

Ways to Pay/View

Online

Pay your current taxes online with a debit/credit card or by electronic check. An additional fee of 2.6% is assessed for this service, minimum order of $1.95 is required. You can view your taxes 24/7, free of charge.

Pay by Phone

To pay your current taxes by phone, call (844) 756-0386. You may pay with a debit/credit card or by electronic check. The fees are the same as online payments (above) plus 95¢.

In Person

Treasurer’s Office counter, located at City Hall Municipal Complex, 26000 Evergreen Road, Southfield, MI 48076; Hours: 8:00 a.m. – 5:00 p.m.

Make the check payable to City of Southfield.

Mail to:

City of Southfield Treasurer’s Office

26000 Evergreen Road

Southfield, MI 48076

Write your tax parcel number on the check and envelope must be postmarked by the due date (metered postmark not accepted).

Delinquent Taxes

All delinquent taxes and those from previous years have been turned over to the Oakland County Treasurer's office and are now payable to Oakland County Treasurer, 1200 N Telegraph Road, Dept. 479, Pontiac, Michigan 48341-0479. Please call the Oakland County Treasurer's office with any questions, (248) 858-0611.

Pay Delinquent Taxes (PDF)

Pay Oakland County with cash at 7-11

Delinquent Tax Timeline (PDF)

Tax Foreclosure Help

If you face a hardship preventing you from paying your property taxes and you are facing foreclosure due to unpaid property taxes, there is a program to help pay your delinquent property taxes up to $30,000. Click on the links below to learn more.